When should you obtain payday loans online? That depends on your personal situation. If you need money quickly and can’t wait until your next paycheck, then a payday loan may be the right solution for you. Online payday loans are convenient and easy to apply for, and you can typically receive your money within 24 hours.

However, it’s important to weigh the pros and cons of borrowing money before you decide to take out a payday loan from US Installment Loans. If you’re unsure, it may be helpful to speak with a financial advisor.

Benefits of Online Payday Loans

When you are in need of some quick cash, a payday loan may seem like the perfect solution. However, before you take out a loan, it is important to understand the benefits and drawbacks of this type of loan. One of the biggest benefits of online payday loans is that they are quick and easy to apply for. In most cases, you can get a loan within minutes of submitting your application. This is much faster than the traditional process of borrowing money from a bank or credit union.

Another benefit of payday loans is that they are typically much easier to qualify for than traditional loans. This is because payday loans are designed for people who have a bad credit history or who have not been able to build up a good credit history.

Moreover, they are also available to people who may not be able to get a loan from a bank or credit union. For example, you may be able to get a payday loan even if you do not have a job.

However, there are also some drawbacks to payday loans. One of the biggest drawbacks is that the interest rates are typically much higher than those for traditional loans. This means that you will end up paying more money in interest if you take out a payday loan.

Another drawback of payday loans is that they can be very expensive if you do not pay them back on time. This is because you will typically be charged a penalty fee if you do not repay the loan on time.

Overall, payday loans obtained can be a useful tool if you need some quick cash. However, it is important to understand the benefits and drawbacks of this type of loan before you decide whether or not to apply for one.

What Do I Need to Apply for an Online Payday Loan?

If you’re considering applying for an online payday loan via US Installment Loans, there are a few things you’ll need to have on hand. The first is a valid bank account, as the loan will be deposited directly into your account. You’ll also need to be employed, as payday loans are not available to those who are unemployed.

In addition, you’ll need to be at least 18 years old and have a valid Social Security number. When you’re ready to apply for a payday loan online, you’ll need to provide some basic information. This includes your name, address, phone number, email address, and Social Security number. You’ll also need to provide your employer’s name and contact information, as well as the amount of your monthly income.

Once you’ve submitted your application, you can usually expect to hear back within minutes. If your application is approved, you can expect the loan to be deposited into your bank account within one business day. Keep in mind that payday loans should only be used as a last resort, as they can be expensive and can quickly spiral out of control.

What Is the Online Process for Applying for a Payday Loan?

The first step is to determine if you’re eligible for a payday loan. You must be a U.S. citizen or permanent resident, and you must be at least 18 years old. You must also have a regular source of income and a checking account.

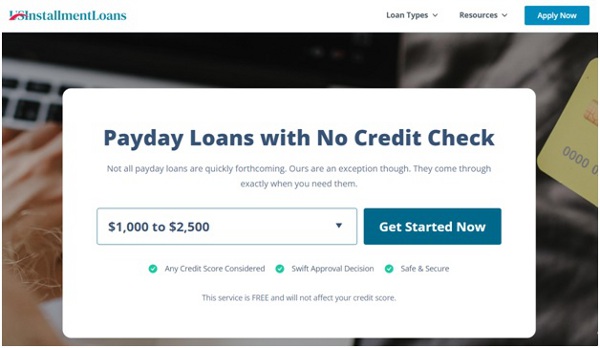

The next step is to find a payday loan provider. There are many providers online, but you can easily find one on US Installment Loans, as the service allows you to compare interest rates and terms before you choose one.

Once you’ve chosen a provider, you’ll need to provide some basic information, such as your name, address, and Social Security number. You’ll also need to provide your contact information and the amount you want to borrow.

The provider will then verify your information and decide if you’re approved for a loan. If you are approved, the provider will transfer the money to your checking account.

It’s important to note that payday loans should only be used as a short-term solution. Borrowing too much can lead to excessive debt, so be sure to borrow what you can afford to pay back on time.

Should I Use a Credit Broker When Applying for an Online Payday Loan?

Payday loans are easy to apply for and typically have a fast turnaround, making them ideal for emergencies. However, one thing to keep in mind is that payday loans often have high interest rates and fees. So if you’re not careful, you could find yourself in a lot of debt.

One option to avoid high interest rates is to work with a credit broker like US Installment Loans. Credit brokers can help you find the best payday loan rates and terms, so you can get the money you need without putting yourself in a difficult situation.

If you’re considering a payday loan, be sure to explore all your options. And if you’re not sure where to start, contact a credit broker for help. They can help you find the best loan for your needs, so you can get through difficult times without added stress.